By Colleen Volheim, category research & analysis manager, as seen in Chain Drug Review

Syndicated data provides insights into chain, big box, and specialty stores, but the data doesn’t always include the detailed category-level data you may desire. Additionally, most providers don’t have data representative of the independent channels, which even though they don’t have as high a volume of sales, still represent roughly 34% of all U.S. retail pharmacies and are important healthcare providers in the communities they serve.

That lack of independent pharmacy channel data, from an objective third party, is what led HRG to develop Retail IN.tell Base in spring 2021. With demonstrated expertise in health, beauty, and wellness (HBW) products for pharmacy front-ends, we developed Retail IN.tell Base, which is powered by our proprietary Tri-PAC data. Tri-PAC utilizes three sources of nationwide sales data, including:

- wholesaler shipment withdrawal data,

- point-of-sale scan data from independent pharmacies, and

- syndicated scan data from the retail drug channel.

These data sources are combined in a performance analysis calculation (PAC) to provide a robust view of distribution and sales that includes the individual product, product type, subcategory, and category. HRG‘s proprietary analytical process allows companies in the HBW segment see a unique view of product performance across the drug channel.

Retail IN.tell Base offers two options for receiving data: Data Hub and Custom Category Reporting. Starting with the September 5th issue of Chain Drug Review, I will be providing snippets on a regular basis of trends from Custom Category Reporting for the category of focus in the issue. In this article, I’m providing an idea of what that information will look like, but these charts are from a recent analysis I did of new item data. In that review, one of the items I dug into was ingredients.

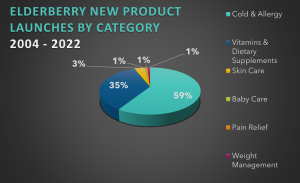

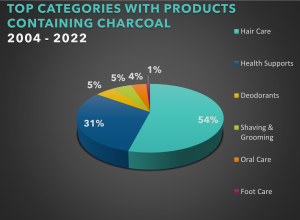

As you can see from the charts depicted, charcoal and elderberry sparked my interest from the standpoint of their increase in use and the span of categories you’ll find products that contain them.

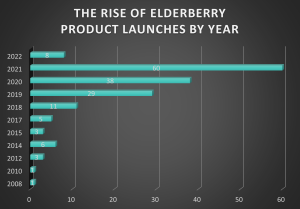

2021 was the peak year of new product launches containing elderberry, but as stated in the key observation, if the trend that we have seen through the first part of 2022 continues, we may see nearly as many new items featuring elderberry as an ingredient as we did in 2020, which was just short of 40.

Also of interest to manufacturers and retailers alike, is the difference in performance within the drug channel. When looking at the brand level, of the top four brands in the cold & allergy category at independent pharmacy, only two of them were in the top four at chain drug stores.

category at independent pharmacy, only two of them were in the top four at chain drug stores.

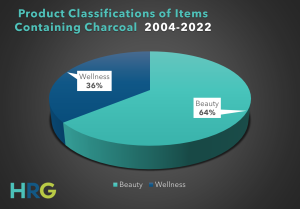

Similarly, when analyzing charcoal as an ingredient at the brand level, of the four top brands containing it across categories, only one of the brands is in the top four at chain drug stores. Another view I looked at regarding charcoal was the breakdown of launches in the wellness versus the beauty classifications. As noted in the key observation, new item launches with charcoal peaked in 2018, while beauty launches peaked in 2019. (HRG classifies these categories as beauty: deodorants, hair care, shaving & grooming, skin care, and sun care; and these as wellness: baby care, batteries, compression support, diabetes management, eye & ear care, family planning, feminine care, first aid, foot care, health supports, home diagnostics and patient aids for daily living, incontinence, nicotine replacement therapy, oral care, vitamins & dietary supplements, and weight management & nutritional foods.)

From the analysis of these two ingredients across new product launches, the difference in performance of brands in independent versus chain drug stores perfectly illustrates the importance of using multiple data sources when developing product growth strategies. Even though you may have been aware of movement differences among channels, you may not have had access to a detailed view of independent pharmacy performance to understand how differently your top competitors performed in one over the other.

From the analysis of these two ingredients across new product launches, the difference in performance of brands in independent versus chain drug stores perfectly illustrates the importance of using multiple data sources when developing product growth strategies. Even though you may have been aware of movement differences among channels, you may not have had access to a detailed view of independent pharmacy performance to understand how differently your top competitors performed in one over the other.

This type of ingredient data, down to the brand level, would be available through Custom Reports of Retail IN.tell Base. Using Custom Reports, HRG analysts create reports from the raw data to fit your specific needs. Looking at competitors capitalizing on a popular ingredient is just one example.

Base. Using Custom Reports, HRG analysts create reports from the raw data to fit your specific needs. Looking at competitors capitalizing on a popular ingredient is just one example.